- Published on

Is Pet Insurance Worth It?

- Authors

- Name

- Robert Claus

What is pet insurance?

Late last year one of our cats had something heavy fall on her paw. We took her to the vet and they had to do surgery on her paw. When we were asked to pay for the surgery, they asked if we had any pet insurance. We did not at the time, but it got me thinking that it might be good to look into it.

I did some research and learned a decent amount about how pet insurance operates. While some are divisions within existing insurance providers, most are smaller insurance providers. Even those that fall under a larger company's umbrella tended to belong to car or home insurance companies, not health insurance.

This means there are some key differences between pet insurance and your own health insurance.

- The insurance is focused on accidents, not general wellness. This means things like vaccinations or check-ups are often NOT covered.

- The companies use high pressure sales tactics. After getting a quick quote in their online pricing tool, I received about a dozen calls and texts within a week.

- There are costly add-ons and decisions beyond just buying a plan.

These companies were attractive with flashy websites at first, but the more I considered their offers (and spam calls) I found them off-putting.

How I think about insurance

Insurance is designed to spread out large one-time payments that would otherwise be impossible to pay off. It typically does this two ways - spreading the cost out over smaller payments and spreading the cost out over many individuals. You can think of it as a savings plan that you pay into every month and then use for large expenses.

One major advantage of insurance over simply saving money is that you can "withdraw" from an insurance company before having paid in an equivalent amount. Another is that larger companies can typically negotiate with the services they pay for and hence provide discounts that way. Finally, it provides some additional protection from price inflation since inflation will only affect future premiums for insurance, but affect all past and future savings in a savings plan.

On the other hand, there are a few factors that make a savings plan more attractive than insurance. Foremost, administrative costs almost certainly make insurance more expensive for the perfectly average customer than just saving/investing the money. Additionally, a savings plan would accrue interest that an insurance plan likely wouldn't. While these factors are important to consider, I didn't include them in the rest of this article for simplicity.

On the non-financial side, most insurance plans can change rates or even kick you off if you are likely to cost them more in the future - this would obviously be disastrous in many situations. What's worse, some insurance plans will accept your payments but not pay if they deem something to be related to a pre-existing condition. These practices have been steadily improving with federal regulation for traditional health insurance, but would likely still occur for pet insurance.

The ability for an insurance company to spread out costs over many individuals means that there are "winners" and "losers" depending on how much they end up using the insurance. If you're willing to take the risk of being a "loser" in return for the chance of being a "winner", the given insurance plan is a good fit. However, it's very difficult to make this decision based on a few numbers a plan gives you.

What makes pet insurance interesting is that it's not widely adopted yet. That means most of the value comes from spreading the payments out over time, not across individuals. This is fairly clear when you look at pricing since the main factor is the annual maximum they will pay. That indicates they are not intended for extraordinarily expensive situations like health insurance, but rather to help smooth out more moderate expenses. It would not surprise me if this pricing factor changes in the future as pet insurance becomes the norm.

Maximum payouts in general also reflect that these plans are ultimately priced more like home or car insurance than healthcare insurance. While it's tragic, there is ultimately a maximum most individuals are willing to pay for a pet's health. At some amount, most families will accept that their pet needs to go to the farm upstate. Unlike a home or car getting totalled, this breaking point is a very emotional decision. That means it will vary dramatically by individual and hence a variety of pricing plans make sense even covering the same types of situations.

Pricing a plan

The main pricing components for these plans are:

- Coinsurance - What percent you pay of any bill even when the insurance kicks in. This is designed to make sure an individual has some "skin in the game" for large purchases. This was the least important factor in the final price, so I largely ignored it.

- Deductibles - How much you pay before the insurance kicks in. This is intended to avoid an excessive volume of smaller claims. By allowing the insurance company to focus on larger claims, they understand their risk better and can hopefully price their plans more efficiently.

- Annual Maximum Payouts - For something like car insurance, this is typically how much they would pay if the car was completely wrecked. This typically isn't a factor in health insurance plans, so it's difficult to reconcile this emotionally for our pets either.

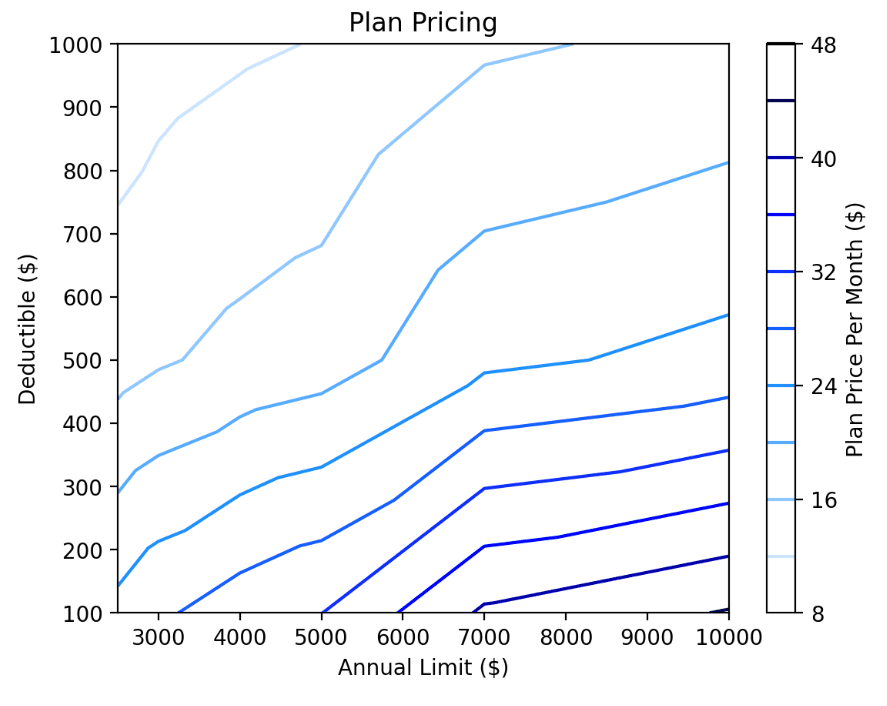

Picking a coinsurance of 30% (the insurance company pays 70%), a plan's price ranges from roughly $10 to $50 per month. We can plot this pricing as contours by interpolating to treat them as if they were continuous functions.

The pricing is somewhat linear with deductible and annual limit. The price jump for annual limits is somewhat progressive - it's cheaper to upgrade from $7000 to $10000 than it is to upgrade from $3000 to $5000. I assume this is because the probability of using that higher coverage is lower.

Calculating value

Given that we can estimate the cost of a plan, we want to relate this cost to our intuitive risk tolerance. For me personally, I think of risk in this area as two variables:

- How frequently do I expect my pet to have a major accident.

- How much do I expect a major accident to cost.

Obviously these are still very approximate, but my personal experience makes me comfortable saying that I can't imagine visiting the vet for a major accident more than every 10 years. Similarly, around $5000 for treatment I would likely be asking for alternative options. This is roughly my personal tolerance.

Given those assumptions, we can calculate the actual cost savings of each plan.

We can use this to calculate the annual savings for all the plans in a given scenario and plot it:

This highlights what plans would be "winners" vs "losers" in this hypothetical scenario. For our example, low deductible plans tend to be bad. This makes sense because a low deductible doesn't benefit us much if we're encountering one larger bill. Hence the risk priced into those plans doesn't pay off for us. Interestingly, we can see that the best plans for us are the ones around the $5000 maximum, matching our scenario. This implies the insurance plans are priced consistently with their annual maximum payments.

Specifically, we find that the best plan for us is to take the maximum deductible ($1000) and the Annual Maximum that matches what we would get paid out that year ($4000).

We can also perform this calculation on a single plan for a bunch of scenarios. For example, here is the amortized expected cost for a plan with a $500 deductible and $5000 annual maximum.

With the lower deductible, we can see that the best scenarios for this plan are if you use it frequently. There is also a subtle change in shape around $5000 accidents. On this chart, we can clearly see that if you expect only one $3000 incident every 10 years, this plan would not be a good fit.

Conclusions

After exploring the data, I could see myself paying for a maximum deductible, $3000 annual maximum plan. This would cover a $4000 procedure and pay for itself even if that only came up once in my pet's lifetime.

It is definitely possible to lose money on insurance even if you use it. It depends a lot on how you end up using it, making it very difficult to choose between plans. Even just picking numbers like a deductible and maximum payout can be nearly impossible. Breaking this down to scenarios makes it a little easier to digest, but not by much.

I will admit, there is also a difference between risk tolerance and maximizing value. For example, many individuals would pay a premium to avoid having to think about money at a time when their pet is sick.